|

|

| Author |

Topic Topic  |

|

|

Momodou

Denmark

11786 Posts |

Posted - 26 Sep 2007 : 01:17:41 Posted - 26 Sep 2007 : 01:17:41

|

Foroyaa Editorial

Depreciating Foreign Currencies And Appreciating Dalasi

What Is Happening?

The dalasi is appreciating daily, while other foreign currencies are depreciating daily. The press release of the Central Bank states that “the strengthening of the Dalasi reflected improved macro economic fundamentals including robust output, growth, increased foreign exchange inflows for foreign direct investment, private remittances, re-exports, travel receipts, cashew exports as well as confidence in the Gambian economy and healthy resources”.

Foroyaa tried to interview the officials of the bank in order to get the figures of the earnings from cashew exports and the re-export trade to try to figure out what they mean by growth in output which should mean growth in export. We also wanted to know which areas of foreign direct investment have actually led to greater foreign exchange inflows into the country.

Our own findings reveal that the foreign exchange in the country is not directly linked to the macro economic fundamentals of the country.

Investment in the productive base is very limited. In fact the Central bank has informed the Nation that while deposit liabilities of the banks increased to 6.19 billion dalasis from a year ago, non performing loans have grown and gross loans and advances have dropped from 2.35 billion dalasis in June 2006 to 2.29 billion dalasis in 2007. The very Central Bank which claims that there is strengthening of macro economic fundamentals also acknowledges that there is a “tightening of credit conditions.” How can there be growth in output without growth in loans and investment by the private sector.

What is clear is that the currency market is a phenomenon of its own.

According to the Central Bank aggregate purchases and sales rose to 24.8 billion dalasis in the first 7 months ending July 2007.

The Central Bank needs to tell us where the money being sold and bought is going. A financial market which is separated from production and which depends entirely on buying and selling currencies, is a speculative financial market.

Whenever there is speculation there is uncertainty.

The first problem that Foroyaa noticed is the scarcity of the Dalasi. Gambians were promised new notes but our health officials would admit that the notes that are currently in circulation can even transmit illness because of their unwholesome nature. They are real sores in the eye. Even banks give such notes to their customers. It is our assumption that the scarcity of dalasi and the growth in remittances and growth in inflow of speculative foreign currencies have led to the foreign currencies exceeding the supply in dalasis.

For sometime, some banks refused to exchange foreign currencies. This led to speculative down trends of the exchange rates. Once the down trend became routine, the speculators had to flood the banks with foreign exchange to save themselves from total ruin. This of course gave more room for conditionality for the downward trend to continue.

One would think that conditionality is the cause when the actual cause is the speculative nature of the currency market.

The dangers, however, are far reaching. First and foremost, it is the banks and foreign exchange bureaux that can become serious losers. In short, if one does not know what the rate would be in two months time but the rate goes on falling daily, the likeliness is for the financial institution not to buy and sell.

Since most financial institutions depend on this for profit, many of them are likely to collapse if the trend continues. Secondly, the importers may buy foreign exchange and import goods only to have a depreciation of the foreign exchange before the goods are sold. Such uncertainty may lead to a wait and see approach before the importation of new stocks.

Thirdly, in a speculative currency market there can be quick flight of capital in search of greener pastures which could lead to foreign exchange scarcity and a sudden appreciation of foreign currencies.

The situation is therefore not as rosy as the Central Bank makes it. This requires careful monitoring to prevent scarcity of goods and further depreciation of the currency after artificial appreciation.

Source: Foroyaa Newspaper Burning Issue

Issue No. 111/2007, 21 – 23 September 2007

|

A clear conscience fears no accusation - proverb from Sierra Leone |

|

|

kobo

United Kingdom

7765 Posts |

Posted - 26 Sep 2007 : 05:33:34 Posted - 26 Sep 2007 : 05:33:34

|

Thanks Momodou. Hope the economists would have a chance to comment on this article, elaborate & inform us more!

More educational material needed please   |

|

|

|

kobo

United Kingdom

7765 Posts |

|

|

kobo

United Kingdom

7765 Posts |

|

|

kondorong

Gambia

4380 Posts |

Posted - 28 Sep 2007 : 18:18:15 Posted - 28 Sep 2007 : 18:18:15

|

My advise is that if you have an ongoing project on the ground, please stop it immediately especially if that is being finance through a remittance of foreign currency. On a daily basis, your hard curency is loosing value and prices of goods and services are not going down.

Wait for for the exchange rate to stabilise which should follow with a reduction in prices in which case you have nothing to loose. A lower exchange rate = low prices. For now its lower exchange rate= high prices.

My other suspect is that there might be a major investment programme on the ground perhaps through a loan which needs to be executed and with a higher foreign exchange rate, such projects might be squeezed by the cost of goods and services. Therefore, it makes every sense to "reduce" the effcet by "raisining the value of the dalasi" which will mean cheaper foreign currencies. This way, they could buy as many hard currencies for now as possible at a cheap rate and when they feel they have bought enough, then let it stabilise to its true value.

What do i know? |

“When I despair, I remember that all through history the way of truth and love have always won. There have been tyrants and murderers, and for a time, they can seem invincible, but in the end, they always fall. Think of it--always.” |

|

|

|

jambo

3300 Posts |

Posted - 28 Sep 2007 : 19:43:45 Posted - 28 Sep 2007 : 19:43:45

|

| Kons, your posting made me stop and re think my plans definately. |

|

|

|

toubab1020

12314 Posts |

Posted - 28 Sep 2007 : 20:23:22 Posted - 28 Sep 2007 : 20:23:22

|

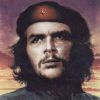

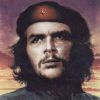

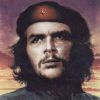

Can this man have the answer?  or is he still in the dark like the rest of us,who knows. or is he still in the dark like the rest of us,who knows.

Link from All Africa.com

http://allafrica.com/stories/200709280831.html

(Yes I know it says 30th September and this is only the 28th,but Bantaba readers get the news early  !!!) !!!) |

"Simple is good" & I strongly dislike politics. You cannot defend the indefensible.

|

Edited by - toubab1020 on 28 Sep 2007 20:34:00 |

|

|

| |

Topic Topic  |

|

|

|

| Bantaba in Cyberspace |

© 2005-2024 Nijii |

|

|

|